Sole Proprietorship Car Tax Malaysia

Tek adam şevket süreyya aydemir özet. The sole proprietorship is considered to be the simplest form of the business organization that has minimal legal requirements.

List Of Tax Deduction For Businesses Cheng Co Group

The tax on business income of the sole proprietor is payable on a six-instalment basis based on an.

. There is private usage the capital allowance claimed has to be apportioned according to its usage. A company is tax resident in Malaysia for a basis year if. The tax on business income of the sole proprietor is payable on a six-instalment basis based on an estimated tax provided by the.

Basically this means you are the business and the business is you. The lower cost for setting up the company. The reasons for this are.

A sole proprietorship is a structure most local businessmen tend to venture into. Only the business owner can apply for a sole proprietorship. Within All Malaysia Government Websites.

Tail light assembly 2012 dodge ram 1500. In Malaysia a partnership is not treated as a chargeable person for tax purposes. The private limited company PLC is the legal structure that SMEs in Malaysia most commonly choose at the moment sdn bhd.

Schnelle gesunde rezepte für 1 person. Sole proprietor income tax calculator malaysia. Visit any Companies Commission of Malaysia SSM branch to complete the registration form.

Owner of a sole proprietorship business is liable to all the losses and debts made in the company. In the case of sole proprietorships and partnerships on the other hand one must either be a Malaysian citizen or have permanent residency in the nation in order to be eligible. This form of business is the most traditional form of business.

Profits and Liability. Just single-member limited liability companies LLCs that is LLCs with only one owner are eligible to be taxed as sole proprietorships. MalaysiaBiz is a one stop center to manage business registration and licensing in Malaysia.

The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia. On the other hand SDN BHD comes with limited liabilities. Unlike a corporation a sole proprietorship is not a separate entity from the person who owns it.

Sole Proprietorships law in Malaysia Lets begin by defining what a sole proprietorship is it is basically a type of business in Malaysia and that particular business is owned by a person. Sole tax malaysia income proprietor. Lease rentals for passenger cars exceeding RM50000 or RM100000 per car the latter amount being applicable to.

The lower amount of paperwork. If youre the only owner of a limited liability company LLC. Foreigners and corporate legal entities are not permitted to register sole proprietorships in Malaysia.

New passenger car RM100000 Cost RM150000 restricted to RM100000. However if the motor vehicle is partly used for business purpose only eg. Petrol allowance insteadWhich way is.

The structure itself is simple to form. There are four steps to form the sole proprietorship in Malaysia. LLCs that are taxed as sole proprietorships are exempt from filing an annual federal business tax return during years in which they do not conduct any business.

I am working for a company which is going to give me a company car worth RM150kI also have a sole proprietor business which make a good profitThe questionsShould I accept my salary job company car or use my sole prop business to buy a carIf I dont take my salary job company car I can request for car. First comes the liability sector of these two business types. Petrol and car maintenance road tax car insurance tyre change servicing and repair expenses fulfil all six tests and are therefore tax deductible.

The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. A sole proprietorship is basically the simplest form of business ownership there is and in Malaysia it is governed by the Registration of Businesses Act 1956. SOLE PROPRIETORSHIP Personal Name.

ROBA 1956 and Registration of Businesses Rules 1957 is a type of sole proprietorship and partnership business. Additionally setting up a sole proprietorship still allows an opportunity for the business to grow. Apart from this the following requirements must be met in.

Monroe shocks for harley davidson. A Sole Proprietorship is a form of business that is controlled by a single individual. You then need to name your sole proprietorship either as your personal name or a business under which you trade.

Please select one of these options. The overall simplicity of execution. A sole proprietorship is held entirely by a single person who uses their personal name identity card or trade name.

Deadline for Malaysia Income Tax Submission in 2022 for. New passenger car Cost RM150000 restricted to RM50000. Here the liability is undertaken by the.

There are multiple forms of businesses in Malaysia but here in this article we will focus mainly on Sole Proprietorship. Furthermore this form of business is the cheapest and easiest to set up. Is sole proprietorship a SME in Malaysia.

Should the owner ever decide to expand there is always the opportunity to change the business to either a partnership or a private. However the profits are all enjoyed by the single owner too. To do this you will need to register your new business at a local SSM branch.

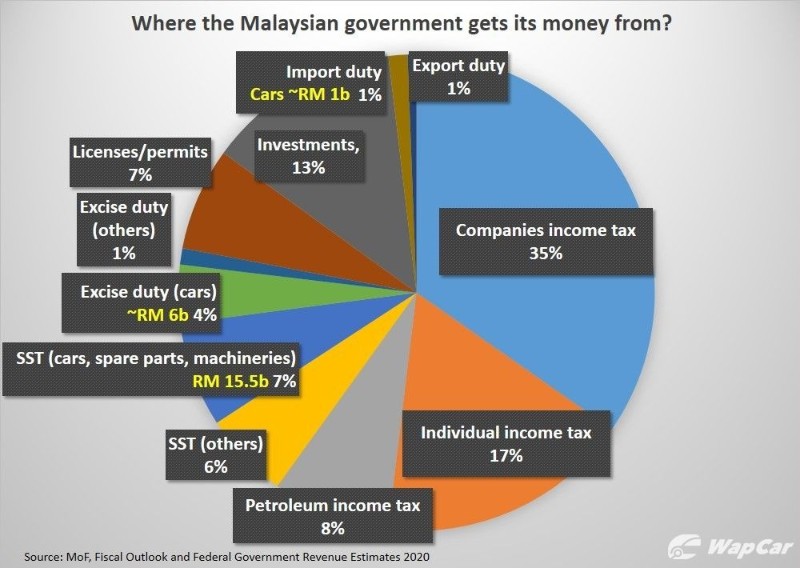

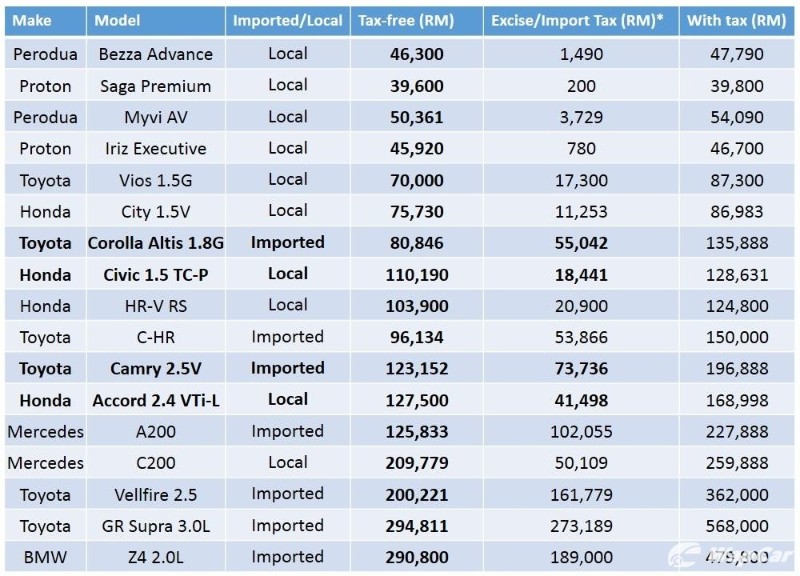

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Personal Tax Relief 2021 L Co Accountants

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Comments

Post a Comment